Home Is Possible Magic: Violet’s True $0 Down Achievement in Home Buying

Hey everyone, Federico here, but today you can call me the real estate wizard of Las Vegas. 🎩✨

Today, I’m super stoked to share a story that’s nothing short of magical.

It’s about Violet, a bright 23-year-old who totally rocked her path to homeownership.

And guess what? She did it with a whopping $0 down – yeah, you read that right!

Picture this: September 2022, the real estate scene is buzzing, and here comes Violet, ready to dive into the world of homeownership.

Now, you might be thinking, “A 23-year-old buying a house, in this economy, with no down payment? No way!” But here’s where the magic happens.

As your friendly neighborhood real estate guide, I had a few tricks up my sleeve – and one of them was the awesome ‘Home Is Possible’ program of Nevada.

This isn’t just any program, folks. It’s a game-changer, especially for young folks dreaming of their own crib but thinking it’s way out of reach.

So, buckle up, and let me take you on this rad journey where we turned Violet’s home-buying dream into a reality, proving that when it comes to real estate: Impossible is just a word…

Continuing the Magic: What’s in Store for You

Alright, so you’re probably wondering, “What’s this Home Is Possible thing, and how can it work its magic for me?” Well, get ready to have your mind blown.

In this blog post, we’re diving deep into the Home Is Possible program – a real gem in the Nevada real estate scene that’s making homeownership dreams come true, especially for the young guns out there.

But that’s not all. Here’s what we’re unpacking today:

- The Lowdown on Home Is Possible:

First off, I’ll break down the nitty-gritty of the ‘Home Is Possible’ program. We’re talking about who it’s for, how it works, and why it’s a total game-changer. This isn’t just another boring real estate talk; it’s the key to unlocking your first home. - The Earnest Money Plot Twist:

Next up, we’ve got the story of Violet’s $2,000 earnest money deposit. Spoiler alert – she got it all back at the end of the deal. Sounds unreal, right? Stick around, and I’ll spill the beans on how we made that happen. - Zero Down Wizardry:

Lastly, we’ll unravel the most exciting part – how Violet bought her house with literally $0 down. Yep, you heard that right. Zero. Nada. Nothing. It’s like pulling a rabbit out of a hat, except this time, it’s a whole house!

So, if you’re sitting there, thinking owning a home is more fantasy than reality, this one’s for you. Let’s demystify the process and show you how to make your own real estate magic. 🏠✨

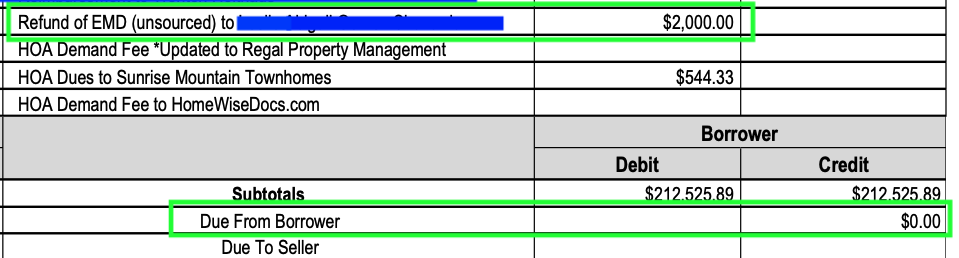

Visual Proof: The Magic in Numbers

Now, I know seeing is believing, so check this out. Below is a snapshot from Violet’s settlement statement.

This isn’t just any old document; it’s the real-deal proof of how we turned the impossible into possible.

In this pic, you’ll spot two mind-blowing figures:

- $2,000 EMD Refund: That’s Violet’s earnest money deposit coming right back to her. Not a penny less. It’s like making a deposit on a dream and then getting your money back to dream even bigger.

- Due from Buyer: $0: And here’s the star of the show – the amount Violet owed at closing? Zero. Zilch. It’s the kind of number that gets every aspiring homeowner’s heart racing.

This is more than just numbers on a page; it’s solid proof that with the right strategy and a bit of magic (aka solid financial planning and some savvy real estate moves), owning a home without emptying your pockets is not just a fantasy.

Violet’s Journey: A Blueprint for Homeownership Success

Meet Violet, a shining example of how determination, clarity of vision, and the willingness to embrace guidance can transform the dream of homeownership into reality.

At just 23 years old, Violet demonstrated the key traits I’ve seen in clients who achieve remarkable results: : determination, persistence, and a clear understanding of what they want.

But what sets Violet apart, and what I particularly admire, is her openness to guidance – a quality I often find in younger clients who bring a refreshing flexibility and receptiveness to the table.

Violet, a vibrant 23-year-old, embodied all these qualities perfectly, making her journey into homeownership a model for others to follow.

Background of Violet: Setting the Stage for Achievement

Unlike some first-time buyers who juggle a mix of often conflicting advice from various sources, Violet’s approach was straightforward and focused.

Violet’s preparation was evident in every aspect of her life. She had a stable job, providing the affordability needed for a home purchase. Her credit score was in the decent-to-good range, smoothing the path for pre-approval.

More crucially, she had been saving money, understanding that financial discipline is key in the home-buying process.

But what truly set Violet apart was her openness to guidance – a trait I find particularly pronounced in younger clients.

They approach the home-buying process with a flexibility and willingness to learn, a stark contrast to some older, first-time buyers who often arrive with a mix of ideas picked up from co-workers, news, or the latest real estate trends.

These older clients, with their myriad of conflicting opinions, can find it challenging to focus and make decisive moves. Their journey is often marked by hesitation – example: waiting for the market to crash, a notion they’ve clung to since 2014, while the market continues its upward trajectory and they continue paying rent, inadvertently supporting someone else’s mortgage.

But Violet was different.

As of November 2023, Violet’s decision has already shown its wisdom. Violet’s story is a testament to the power of clear goals, preparedness, and the importance of trusting professional advice in the journey to homeownership.

She didn’t fall into the trap of waiting for a market crash or getting lost in the noise of fluctuating trends. When she decided to buy her house in September 2022 for $198,500, many were speculating about a market downturn.

Fast forward to November 2023, and Violet’s decision has proven astute; her property’s value has increased to around $230,000.

Her story isn’t just about the successful purchase of a home; it’s a testament to the power of having a clear goal, being prepared, and the importance of embracing professional advice in the fast-paced world of real estate.

Violet’s journey underscores a vital truth in real estate: success isn’t just about timing the market; it’s about being prepared, knowing what you want, and being open to the guidance that can turn dreams into reality.

Laying the Groundwork: The Crucial First Step of Pre-Approval

Embarking on the path to homeownership, especially as a young buyer like Violet, is akin to setting out on any grand adventure or ambitious goal.

You have the destination in mind, but the roadmap on how to get there might be unclear.

This is where building a solid, trustworthy team becomes crucial.

Securing the Foundation: Violet’s Pre-Approval Journey

When Violet approached me, the first and most vital step we took was getting her financing in order.

Finding the right loan officer is about more than just securing a loan; it’s about finding someone who can present you with options and guide you through them.

A proficient loan officer doesn’t just process applications; they lay out multiple pathways for financing, empowering you to make informed choices.

In Violet’s case, this included considering the Home Is Possible program – a valuable resource that, unfortunately, is often overlooked by professionals focusing on their financial gain rather than their fiduciary duty to clients.

It’s disheartening yet not uncommon to encounter clients who’ve been steered away from beneficial programs like Home Is Possible by their loan officers or even real estate agents.

These professionals sometimes resort to petty tactics and misinformation, shaping a negative narrative around such programs.

But our role as fiduciaries is to prioritize the client’s interests above all else, presenting all viable options without bias.

Violet was aware of the Home Is Possible program and was keen to explore it as a first-time buyer. Though she lacked detailed knowledge about the program, she was open to learning and considering it as a viable option.

True to her decisive nature, upon understanding how Home Is Possible aligned with her financial situation, she opted for it.

This decision was a significant one, reflecting her ability to weigh options and choose what suited her best.

With the choice made, our loan officer worked diligently to secure the necessary pre-approval. This pre-approval wasn’t just a piece of paper; it was Violet’s ticket to the exciting world of house hunting, a testament to her readiness and commitment to her goal of homeownership.

As we embarked on this next phase, Violet’s preparedness and trust in our team set the tone for a journey marked by smart decisions and successful outcomes.

The Hunt Begins: Navigating the Real Estate Landscape

With pre-approval in hand, Violet and I dove into the exciting phase of house hunting. This wasn’t just about finding a house; it was about discovering a place Violet could call home, a space where her dreams and future would unfold.

Unlike many homebuyers who find themselves overwhelmed by the plethora of options, our search was surprisingly straightforward.

Thanks to Violet’s clear vision of what she wanted, we didn’t have to sift through a myriad of listings or visit countless properties.

She had a firm grasp on her needs and preferences, which were aligned not just with her lifestyle and aspirations but also with her budget. This clarity and focus significantly streamlined our search, making it a more targeted and efficient journey towards finding her ideal home.

Striking Gold on Burcot Avenue: Violet’s Smart Home Choice

And then, boom – we came across a gem on Burcot Avenue. This was where my role as a negotiator really came into play.

I managed to secure a fantastic deal for Violet: the seller agreed to contribute a whopping $7,700 towards her closing costs.

Why was this possible? Because the property, while not the epitome of luxury, was exactly what Violet was looking for.

Negotiating a Win on Violet’s Dream Home

As a first home for a 23-year-old, this house was perfect. Many first-time buyers fall into the trap of seeking the most upscale house in the most sought-after neighborhoods.

But such properties often come with premium pricing, with sellers expecting bidding wars and less inclined to offer concessions. VIolet’s choice was different.

The house she selected was in great condition, as you can see in the photo carousel included here:

While the house didn’t boast high-end upgrades like a kitchen backsplash or granite countertops, it had its charm and potential.

This is a crucial lesson for home buyers, especially those needing significant seller contributions: be open to properties that may need some upgrades.

From this experience, we learn an important principle: always think about the resale when buying a home.

My advice to homeowners is to undertake a major renovation annually. One year, it might be installing granite countertops in the kitchen and bathrooms. The next year, consider new flooring. Then, a fresh coat of paint. And remember, always opt for neutral colors and finishes. Highly personalized choices like red walls or black tiles might not appeal to the majority of buyers.

By keeping your home updated, you’re not just maintaining it; you’re enhancing its value.

This approach positions you to sell your home for top dollar in the future, potentially sparking a bidding war while minimizing your closing costs.

The bigger picture here is about growing your equity. I’ve seen clients who started their real estate journeys years ago now living rent-free, driving their dream cars, or owning multiple properties. It’s all about smart choices, timely upgrades, and thinking ahead.

Violet’s story on Burcot Avenue is more than just a tale of a young woman buying her first home. It’s a blueprint for smart home buying and financial growth – a path that begins with a single, well-thought-out decision.

Full Disclosure: The Certified Settlement Statement Revealed

Now, for those of you who love the nitty-gritty details and want to see exactly how Violet’s deal played out, I’ve got something special for you. Below is the full Final Certified Settlement Statement from Violet’s transaction.

This isn’t just a summary; it’s the complete, unfiltered document that lays out every financial aspect of her home purchase.

See the Full Final Certified Settlement Statement by clicking here

Take a moment to look through it. You’ll see the seller contributions, the closing costs covered, and the total investment Violet made.

This document is a testament to the successful negotiation and smart financial planning that marked Violet’s journey to homeownership. It’s a clear illustration of how understanding the real estate process, coupled with expert guidance, can lead to favorable outcomes for buyers, especially first-timers like Violet.

Celebrating the Milestones: A Dream Realized

The culmination of our house-hunting expedition was nothing short of a triumph. Violet found a home that not only met her criteria but also felt right – a place where she could see herself growing and thriving. It was a property priced at $198,500, a perfect match for her financial situation and lifestyle needs.

But the success of this journey wasn’t just in finding the right home; it was also in navigating the financial aspects seamlessly.

Remember the $2,000 earnest money deposit Violet made? It was fully refunded to her at the close of the transaction – a financial win that is not always easy to achieve. This refund was a significant boost, a little extra financial breathing room as she embarked on her new life as a homeowner.

Furthermore, the fact that Violet was able to buy this home with literally $0 down payment is a testament to the effectiveness of the Home Is Possible program and the importance of having a knowledgeable team.

The program’s benefits were perfectly aligned with her financial standing, enabling her to step into homeownership without the burden of a hefty initial outlay.

Violet’s journey to homeownership is a powerful reminder that with the right preparation, guidance, and resources, achieving the dream of owning a home is within reach, even in challenging markets. Her story is one of empowerment, smart planning, and the fulfillment of a dream, setting a shining example for young, aspiring homeowners everywhere.

Conclusion and Thank You

As we wrap up Violet’s story, I extend my heartfelt congratulations to her on this remarkable achievement.

Her journey is a beacon of inspiration and a guidepost for others who aspire to own a home.

To Violet, thank you for entrusting me with your journey. Your trust, eagerness to learn, and decisive action were key in turning your homeownership dream into reality.

Key Takeaway:

Violet’s story illustrates the importance of readiness, the right financial tools, and expert guidance in the home-buying process.

Hot Takeaway: Is Timing the Market Less Crucial Than We Think?

How crucial is timing the market in real estate? Violet’s journey offers a compelling answer. Often, prospective buyers get caught up in trying to predict market trends, waiting for the ‘perfect’ moment to buy.

But Violet’s experience turns this notion on its head, showing that personal readiness and seizing opportunities as they come can be far more impactful.

Violet didn’t wait for market predictions to align with her ideal scenario. Instead, she focused on what she could control: her financial preparedness, her understanding of what she wanted in a home, and her readiness to act when the right opportunity presented itself.

This approach not only led her to successfully purchase a home but also to see an increase in its value in a relatively short period.

Her story prompts us to reconsider the traditional emphasis on market timing. While it’s important to be aware of market conditions, Violet’s experience underlines the significance of being financially and mentally prepared.

It’s about being in a position to make a move when the right opportunity arises, rather than waiting indefinitely for market conditions that may never materialize as expected.

So, the real question is: Are you preparing yourself to grab opportunities, or are you waiting for the market to give you a perfect sign?

Ready to embark on your own successful real estate journey? Contact me today, and let’s transform your homeownership dreams into reality, just like we did for Violet!

About Federico Calderon:

Hi there, I’m Federico Calderon, and my passion lies in guiding young individuals on their journey into the world of real estate.

My approach is more than just transactional; I’m deeply invested in educating and mentoring the younger generation. Why? Because I see these bright, aspiring individuals not just as clients, but as the future moguls of the real estate world.

Taking the time to teach, to explain the ins and outs of the process, is something I do with dedication and enthusiasm. For me, every young person I help is an opportunity to plant a seed for future growth – both theirs and mine. Their success stories are the milestones that mark my own journey in this industry.

With 18 years of experience in both mortgage lending and real estate, I bring a wealth of knowledge and expertise to the table. I am here to be a resource, a guide, and a partner in achieving your real estate goals. Whether you’re taking your first step into property ownership or aiming to expand your investment portfolio, I am here to support your aspirations.

Here’s to your success, and remember, I’m just a message away, ready to help you navigate and succeed in the dynamic world of real estate.

Other things to consider:

Understanding the Costs: Appraisal and Home Inspection

An important aspect of Violet’s home-buying journey, which merits attention, is the handling of certain unavoidable costs: the appraisal and the home inspection fees. It’s essential for potential homebuyers to understand that while programs like ‘Home Is Possible’ can significantly reduce the down payment and closing costs, there are certain expenses that are typically the buyer’s responsibility.

In Violet’s case, as with most home purchases, she was required to pay for the property appraisal and the home inspection out of pocket. These costs are a standard part of the due diligence process when going into a real estate contract. Here’s why they are important and non-refundable:

- Appraisal Fee: This fee covers the cost of a professional appraisal, which is a necessary step in the mortgage process. The appraisal ensures that the lender is not providing a loan for more than the property’s worth. This fee is paid directly to the appraisal company and is usually required to be paid upfront.

- Home Inspection Fee: The home inspection is a critical step for the buyer to understand the condition of the property. This fee is paid to a home inspector who assesses the property for any potential issues. Like the appraisal fee, this is usually an upfront cost.

It’s important to note that these fees are paid outside of escrow and are typically non-refundable. This is because:

- Immediate Service Payment: These fees cover services that are rendered immediately after going into contract. Once the appraisal and inspection are completed, the professionals involved have provided their services and must be compensated.

- Standard Buyer Obligation: Paying for the appraisal and home inspection is a standard practice in real estate transactions. It’s an investment into the due diligence process, ensuring that the buyer is making an informed decision.

While Violet benefited from the ‘Home Is Possible’ program for her down payment and closing costs, the appraisal and home inspection fees were necessary expenditures on her path to homeownership. This is a common scenario for most buyers and is an important budget consideration when planning a home purchase.

![Achieving Excellence in Rental Management: Las Vegas Edition [7 Proven Strategies for Unbeatable Success]](https://grandprixproperties.com/wp-content/uploads/2023/10/Rental-Management-Las-VEgas-Edition-768x439.webp)